DIY Accounting Tips for Small Businesses in Westchester County

Understanding the Basics of DIY Accounting

For small business owners in Westchester County, managing finances efficiently is crucial. While hiring a professional accountant is always an option, many business owners choose to handle their own accounting to save costs. Understanding the basics of DIY accounting can empower you to keep track of your finances and make informed decisions.

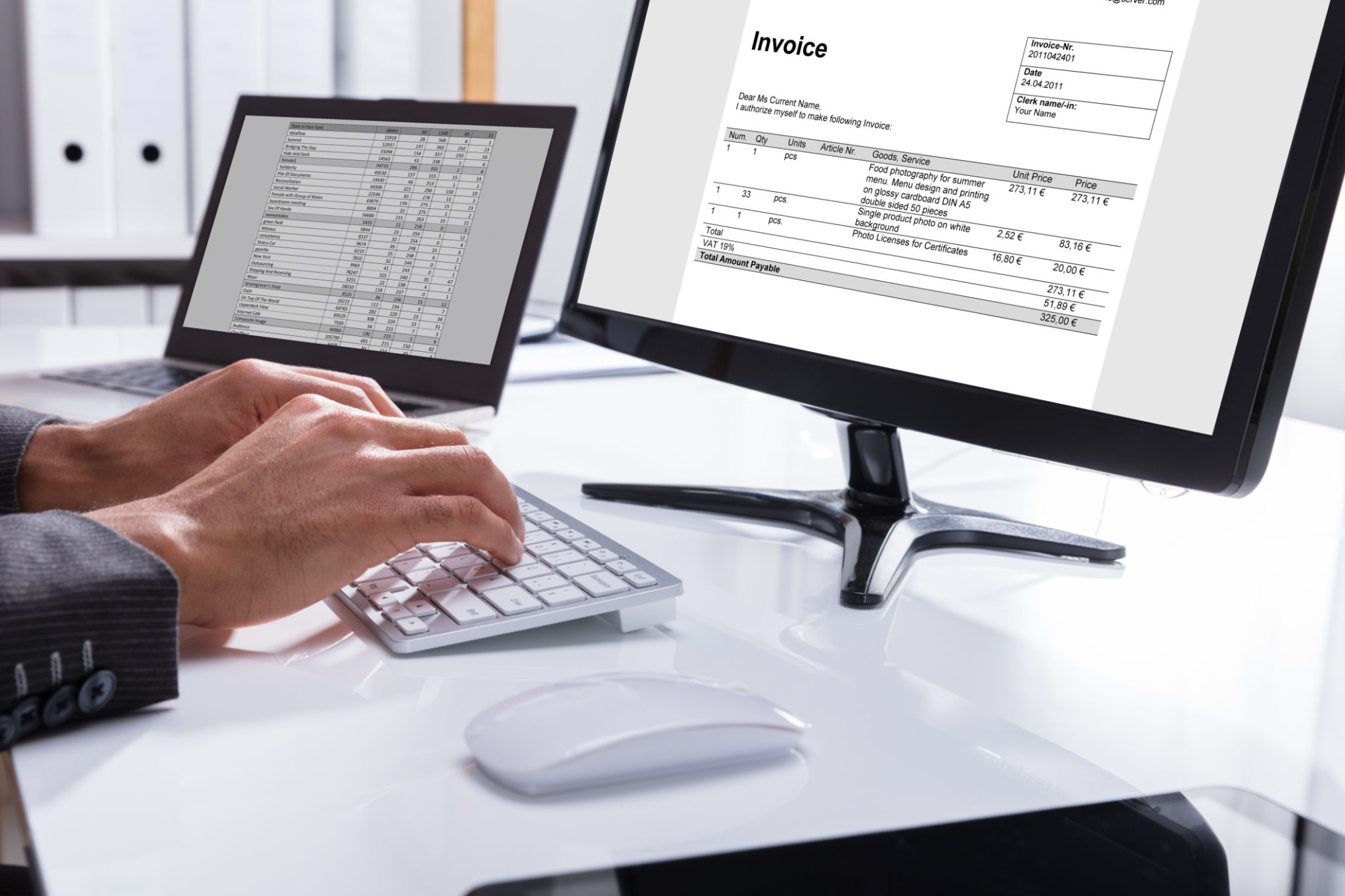

Organizing Your Financial Documents

The foundation of effective DIY accounting is organization. Start by setting up a dedicated space for your financial documents. This includes invoices, receipts, bank statements, and any relevant contracts. Use digital tools like cloud-based storage to keep everything accessible and safe from physical damage.

Selecting the Right Accounting Software

Choosing the right accounting software is essential for small business owners. Many affordable options cater to various needs, from basic bookkeeping to comprehensive financial management. Look for software that offers features like expense tracking, invoicing, and tax preparation. Popular choices include QuickBooks, Xero, and FreshBooks.

Tracking Income and Expenses

Regularly tracking income and expenses is vital for maintaining a clear view of your business's financial health. Set aside time each week to update your books. This habit will help you identify trends, manage cash flow, and prepare for tax season without the last-minute scramble.

Implementing a Budget

A well-structured budget is a critical component of successful DIY accounting. Begin by analyzing past financial data to create realistic estimates for future income and expenses. Adjust your budget monthly or quarterly to reflect changes in your business environment or seasonality.

Understanding Tax Obligations

Small businesses in Westchester County must comply with local, state, and federal tax regulations. Familiarize yourself with these obligations to avoid penalties. Keep track of important dates and ensure you file necessary forms on time. Consider consulting with a tax professional annually to review your filings and get advice tailored to your business.

Managing Payroll Efficiently

If your small business has employees, managing payroll efficiently is crucial. Ensure you understand wage laws and tax requirements specific to Westchester County. Use payroll software to automate calculations and stay compliant with regulations while minimizing errors.

Regularly Reviewing Financial Reports

Finally, routinely reviewing financial reports is essential for small businesses aiming for growth. Analyze balance sheets, income statements, and cash flow statements to gain insights into your business's performance. Regular reviews will help you make informed decisions and identify areas needing improvement.

By following these DIY accounting tips, small businesses in Westchester County can maintain control over their finances, ensuring long-term sustainability and success.